Featured

- Get link

- X

- Other Apps

Earnings Power Value Calculator

Earnings Power Value Calculator. The higher the bep ratio, the better. Basic earning power ratio = ebit / total assets.

Let us look at how the value of those $500 changed, or how their buying power changed, from 1913 to 2018. Earnings power value (epv) estimates the intrinsic value. Earnings power value, also known as just earnings power, is a valuation technique popularized by bruce greenwald, an authority on value investing at columbia university.

The Above Equation Calculates Npv.

You can also calculate numbers to the power of large exponents less than 2000, negative exponents, and real numbers or decimals for exponents. (the year of reference).= 12,682.17 purchasing power (251.107 / 9.9). Let us look at how the value of those $500 changed, or how their buying power changed, from 1913 to 2018.

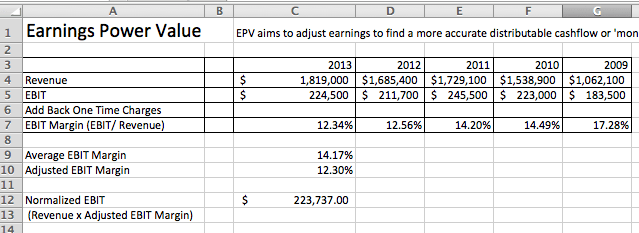

Earnings Power Value Spreadsheet (Example) To Demonstrate How We Can Calculate The Earnings Power Value, We Have Created A Spreadsheet.

The question always arises as to what extent the existing earning power of the valued company can be transferred to the buyer in the event of a sale. The ebit margins of the past five years (instead of one year) are considered, as the company earnings are high in some years and low in some years. Income value = income / capitalisation rate = 1,000,000 / 20% = 5,000,000;

Pfizer Earnings Power Value (Epv) Calculation.

Earnings power value (epv) is derived by partitioning a company's adjusted earnings by its weighted average cost of capital (). X, having a surplus of $65,000, wishes to make an investment. There is no variable for growth.

Discounted Cash Flow Analysis Is Used To Estimate The Present Value Of A Series Of Future Cash Flows.

This is a mathematical equation and not subject to alternative interpretation. Earnings power value also known as just earnings power is a valuation technique popularised by bruce greenwald, an authority on value investing at columbia university. Earning power value (epv) approach.

Basic Earning Power Ratio Tells That Dell Has A Raw.

It's obvious from the % of work completed that we are behind schedule. Intrinsic value estimation using epv is done purely on basis of the ability of company to generate consistent profits (ebit) from its operations. Reproduction value of $4.63 shows that microsoft has a big competitive advantage.

Popular Posts

Calculating Carpet Area From Floor Plan

- Get link

- X

- Other Apps

Comments

Post a Comment